Technical Assessments of Semiconductor Companies for Investment Firms

At Chipinvent Consulting, we provide in-depth technical evaluations of semiconductor companies tailored to investment institutions. Our services aim to guide financial professionals in making informed, data-driven decisions by offering comprehensive analysis on industry trends, screening criteria for high-quality projects, and investment risk assessments. We focus on helping investors identify valuable opportunities in the semiconductor sector while minimizing risks.

Investment Trends in Semiconductors and AI Ventures

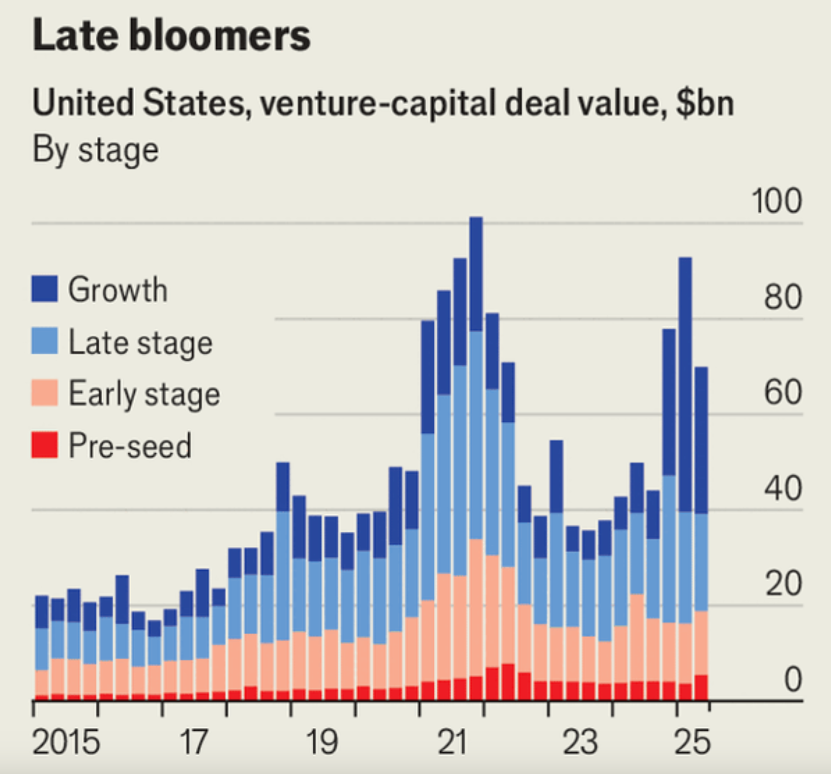

The semiconductor and AI sectors are experiencing significant shifts in venture capital investment. The chart below illustrates U.S. venture capital deal values from 2015 to 2025 (in billions of USD), segmented by financing stage:

Dark Blue: Growth Stage

Light Blue: Late Stage

Light Orange: Early Stage

Red: Pre-seed Stage

This segmentation reveals clear investment trends, showing that funding patterns vary significantly across different stages of development, particularly in the semiconductor industry.

Key Observations by Stage

Pre-seed Stage:

Investments in the pre-seed stage consistently remain the lowest, with minimal fluctuations. This indicates a steady but modest financing volume for early-stage companies, where the risk is higher, and technology is still in development.Early Stage:

While funding at the early stage has increased, it has not kept pace with the rapid growth observed in the late and growth stages. Early-stage investments typically focus on developing new technologies but have not yet proven widespread market adoption or scalability.Late Stage & Growth Stage:

The late and growth stages dominate U.S. venture capital activity, with dramatic fluctuations in deal values. These stages often involve substantial investments in more mature semiconductor companies, reflecting a strong preference for businesses that have demonstrated technological viability and market potential.

Context: Shifting Industry Trends

In 2023, the U.S. venture capital market faced significant challenges. The funding boom of 2021, driven by pandemic-era conditions, led to the emergence of 344 unicorns (private companies valued over $1 billion) in the U.S. However, by 2023, that number had fallen to just 45.

This downturn can largely be attributed to rising interest rates, which have cooled the venture capital climate. Many companies that reached unicorn status during the boom are now facing major valuation corrections. These “zombie unicorns”—companies that are unlikely to sustain their inflated valuations—continue to influence the investment ecosystem, especially in the semiconductor space.

Investment Implications for Firms

Focus on Mature Companies: The dominance of growth and late-stage funding underscores the preference for mature semiconductor companies with proven technology and market traction. Investors targeting these stages should be prepared for a competitive landscape.

Technology & Market Timing: With emerging technologies like AI and quantum computing, investors should keep an eye on semiconductor companies at the forefront of these innovations, particularly in the growth and late stages. However, early-stage investments carry higher risks, requiring careful evaluation of scalability and technological feasibility.

Economic Climate Awareness: The shift from a funding boom to a more cautious market environment highlights the need for investors to factor in macroeconomic conditions, such as interest rates, when making decisions in the semiconductor industry.

Conclusion

Chipinvent Consulting’s technical assessments provide valuable insights to investment firms navigating the semiconductor sector. By understanding investment trends, identifying high-potential projects, and evaluating associated risks, we help our clients make informed, strategic decisions. With our support, investment firms can capitalize on opportunities while managing risk in a rapidly changing market.

Let us help you make smarter investment choices in the semiconductor industry.